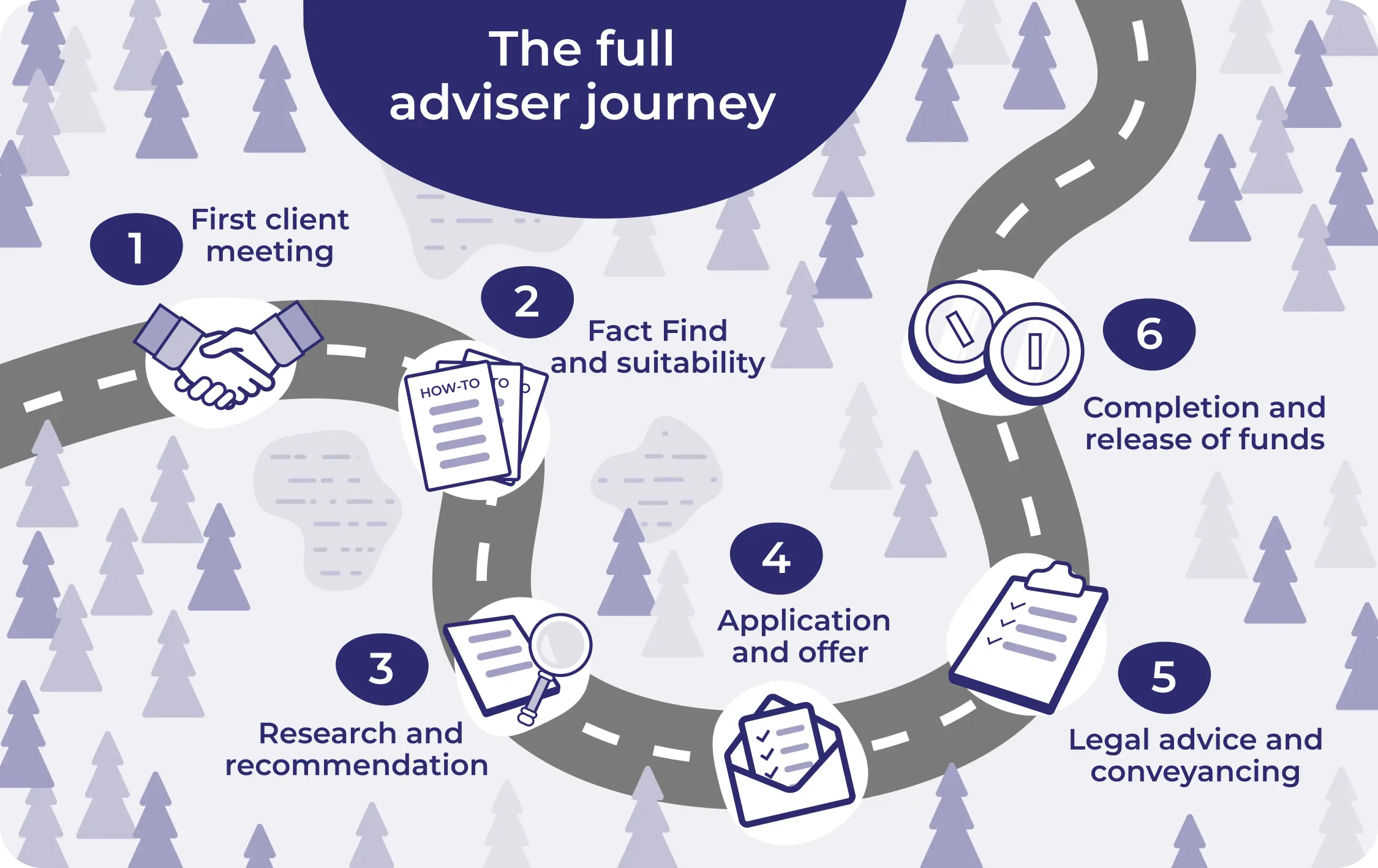

The full adviser journey: From first client meeting to completion

24 September 2025

What every adviser should know about guiding clients through the later life lending process

Equity release is more than a transaction, it’s a life-changing decision for your client, and the adviser journey is central to making it safe, compliant, and successful. Whether you’re new to the market or want to sharpen your process, understanding the full timeline from first meeting to completion is essential.

In this article, we’ll break down the equity release advice journey step by step, covering client engagement, fact-finding, recommendation, application, legal, and completion, along with tips and tools to help at every stage.

Here’s how to guide your client from first conversation to successful completion with tips, tools, and FCA-aligned best practice at every step.

Step 1: First client meeting - building trust and understanding

The initial meeting is where you lay the foundation. Many clients are exploring equity release for the first time, so your job is to educate, reassure, and explore suitability, not sell.

What to do:

Top tip: Encourage family involvement from the start. It builds transparency and trust and supports FCA guidance around vulnerable customers.

Step 2: Fact Find and assess suitability

A thorough Fact Find is critical. You’ll gather detailed information on the client’s circumstances, including all those soft facts and notes that are essential to review the client case, and assess whether equity release is suitable and appropriate.

What to cover:

- Property value and ownership

- Age, health and life expectancy

- Income and outgoings

- Mortgage or other debts

- Benefits entitlements

- Future plans and inheritance goals

At this stage it’s good practice to assess affordability, ability to access means-tested benefits and any potential vulnerability concerns.

Use the Advise Wise Platform for a digital, guided Fact Find template that integrates directly into your client case and recommendation workflow.

Step 3: Research and recommendation

Once you’ve confirmed suitability, you’ll need to source and recommend the most appropriate product.

What to consider:

- Loan-to-value (LTV) and maximum release amount

- Interest rate (fixed for life)

- Product features: drawdown, inheritance protection, early repayment options

- Provider reputation and service levels

- Whether a health-enhanced product may offer better terms

The recommendation must be compliant, clear and justified, with a written suitability report that outlines why the plan is right for your client.

The Advise Wise Platform can help you source and compare products side-by-side, apply filters, and download pre-populated suitability reports in minutes.

Step 4: Application and offer

Once your client agrees to proceed, you’ll submit the application. This will trigger a valuation and underwriting process by the provider.

Process:

- Submit the application through your sourcing platform

- Lender arranges a property valuation

- Provider assesses the case

- Offer is issued to the client, their solicitor and the lender’s solicitor

Make sure your client understands the key facts illustration (KFI), the timeline ahead, and what their solicitor will do next.

Step 5: Legal advice and conveyancing

Independent legal advice is a regulatory requirement for all equity release customers. A specialist solicitor will:

- Explain the plan and its legal implications

- Ensure the client fully understands their rights

- Coordinate the conveyancing process with the lender

- Help arrange completion dates

Referring your client to a specialist solicitor ensures a smoother and more efficient process but also a much easier and quicker completion. Relying on their legal expertise tailored to equity release can reduce the risk of delays or complications, even for those more complex cases.

To manage your customers expectations it's worth informing them that the lender will also have their own legal representation. This is separate from the customers specialist solicitor.

The Equity Release Council requires that legal advice is provided in person, ensuring informed decision-making.

We’ve partnered with carefully selected specialist solicitors throughout the UK. You can select and instruct them with one-click from your client case on the Advise Wise Platform, ensuring an exclusive deal for your client, too! Visit our legal hub

Step 6: Completion and release of funds

Once legal checks are complete, the lender confirms a completion date, and funds are released.

Completion includes:

- Discharging any existing mortgage (if applicable)

- Transferring the remaining funds to the client’s account

- Final documentation issued to both client and adviser

This is your opportunity to follow up, check in with the client, and support them post-completion. Many advisers also use this moment to encourage client testimonials or referrals.

Final thoughts: Mapping a seamless equity release journey

A smooth and successful equity release journey relies on:

- A strong client relationship built on trust

- Robust compliance and suitability processes

- Smart technology to speed up sourcing and documentation

- Ongoing communication between adviser, client, solicitor and lender

Every equity release case is different, but following a clear, client-centred process ensures you’re offering the best possible advice. The more confident and prepared you are, the smoother the journey for both you and your client.

The Advise Wise Platform is built to support advisers through every stage, from Fact Find to recommendation to completion. It’s free to use, whole-of-market, and packed with features to simplify your process.